Localización Canarias Modelo 420

In the field of business management, having efficient tools tailored to the specific needs of each region is crucial. In the case of companies located in the Canary Islands, the Government has implemented Model 420, a fiscal regulation designed to simplify and streamline billing and tax declaration processes. To further facilitate this management, we have developed a specific solution within the Odoo business management system.

In this article, we will explore what the Canary Islands Government's Model 420 entails and how our Odoo development can help you efficiently meet its requirements.

What does the Canary Islands Government's Model 420 entail?

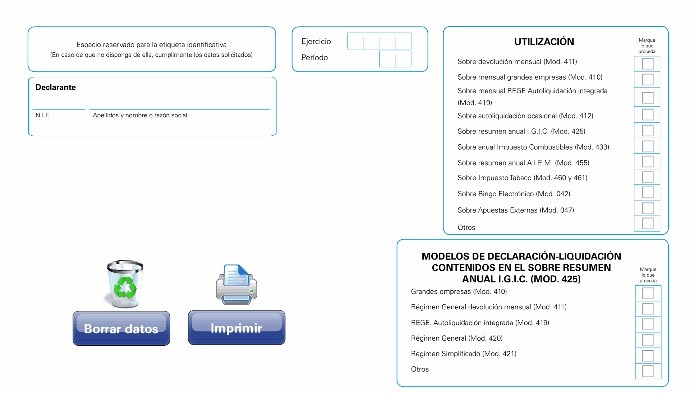

The Model 420 is a declaration.

It's an informative return that companies conducting transactions subject to the Canary Islands Indirect General Tax (IGIC) must file. This model aims to gather relevant information about operations carried out during the fiscal year, allowing the Government to monitor and verify compliance with tax obligations.

The Model 420 includes

Data on operations such as imports, exports, intra-community acquisitions, and internal transactions subject to IGIC. The filing of this return is mandatory for all Canary Island companies conducting these operations, regardless of their size or sector of activity.

Development for Odoo

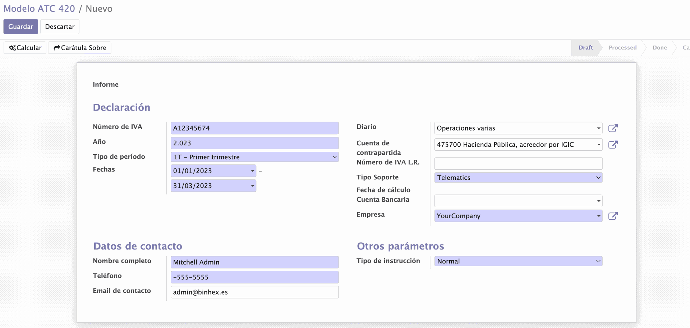

To facilitate the submission of the Model 420 to the Government of the Canary Islands, we have developed a specific solution in Odoo that automates much of the process.

Our Odoo development allows Canary Island companies to generate and submit Model 420 quickly and easily. Some of the key features of this solution include:

Benefits of using our Odoo development

By implementing our solution for Model 420 in Odoo, Canary Island companies can enjoy the following benefits:

1.Time and resource savings: The automation of the Model 420 generation and submission process significantly reduces the time and resources required to fulfill this tax obligation.

2. Precision and regulatory compliance: By automating calculations and generation

Implement this addon in your Odoo ERP.

Optimize your processes by performing automated tasks.